California DMV Practice Test iOS App

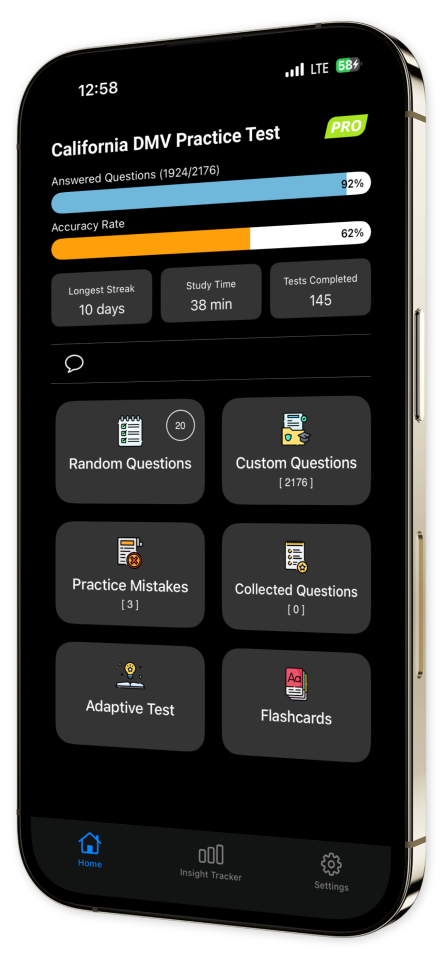

Master your California DMV exam preparation with California DMV Practice Test! Our app is meticulously crafted to simulate the exact test conditions, offering a rich diversity of practice questions that comprehensively cover all essential areas for your driver's license certification. Each question is accompanied by an insightful explanation to deepen your knowledge and refine your driving skills.

Key Features:

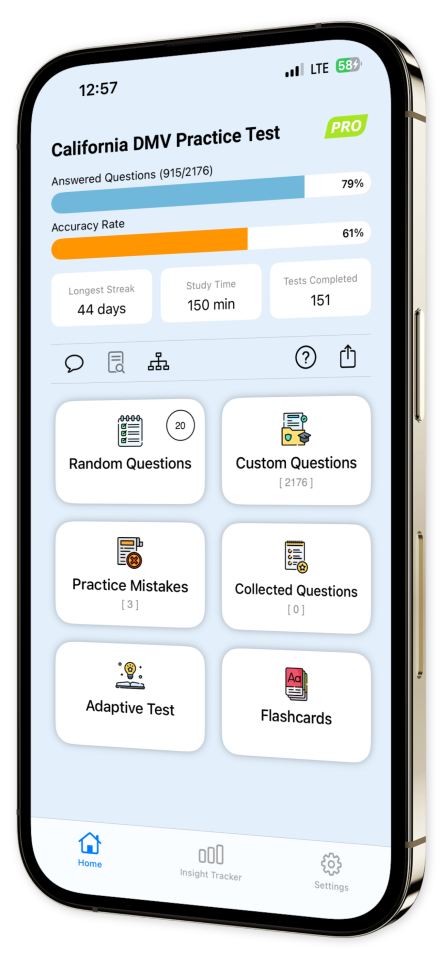

Extensive Question Bank: Tap into a vast array of practice questions targeting crucial topics to ensure a holistic preparation approach.

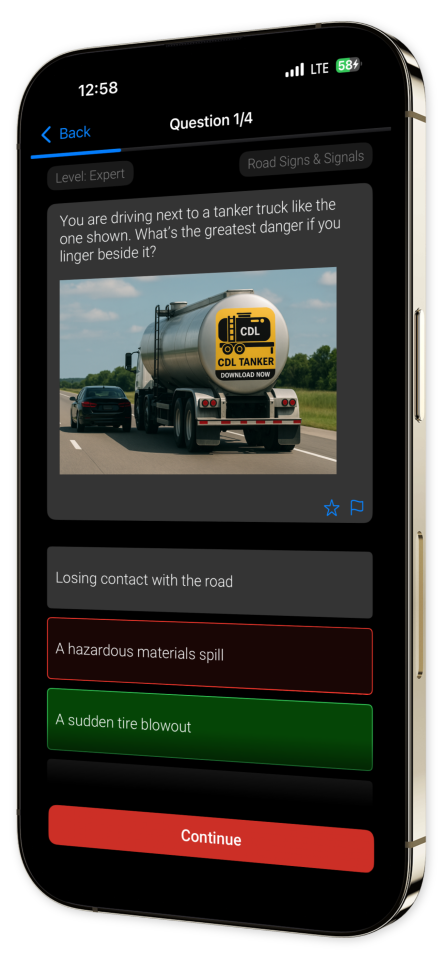

In-Depth Explanations: Enrich your understanding with detailed rationales for every question, designed to enhance both learning and memory retention.

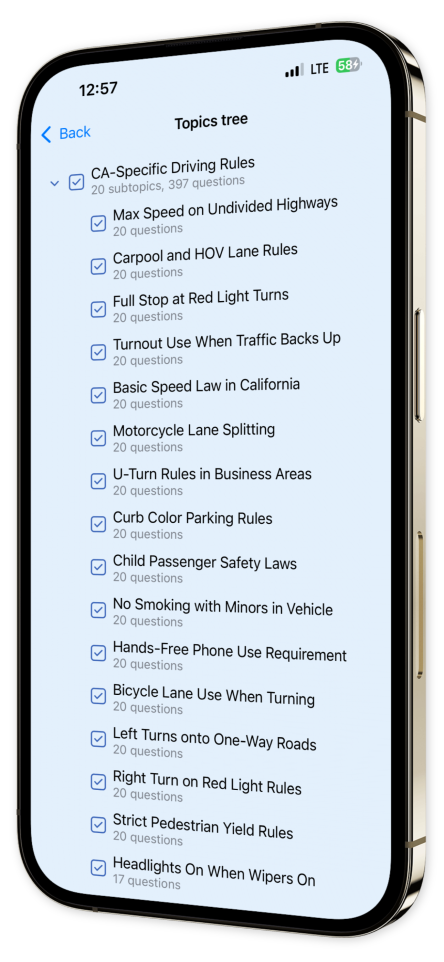

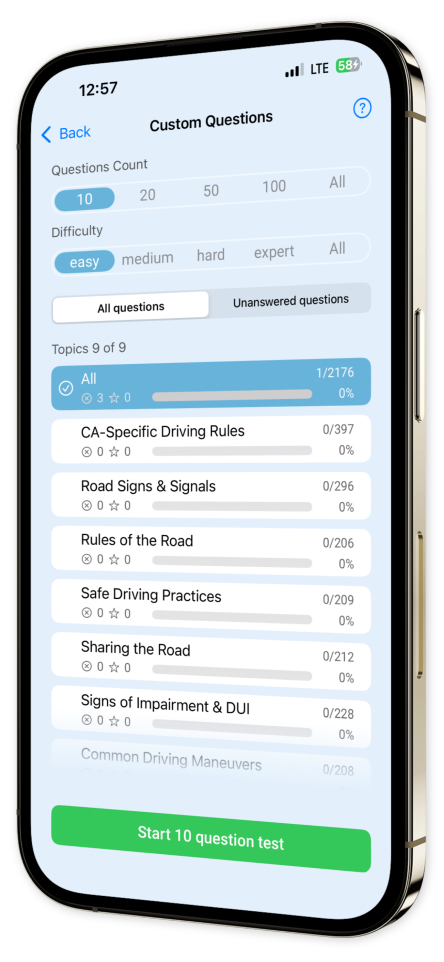

Customizable Quizzes: Tailor your study sessions by creating personalized quizzes from selected topics and question types, focusing exactly where you need improvement.

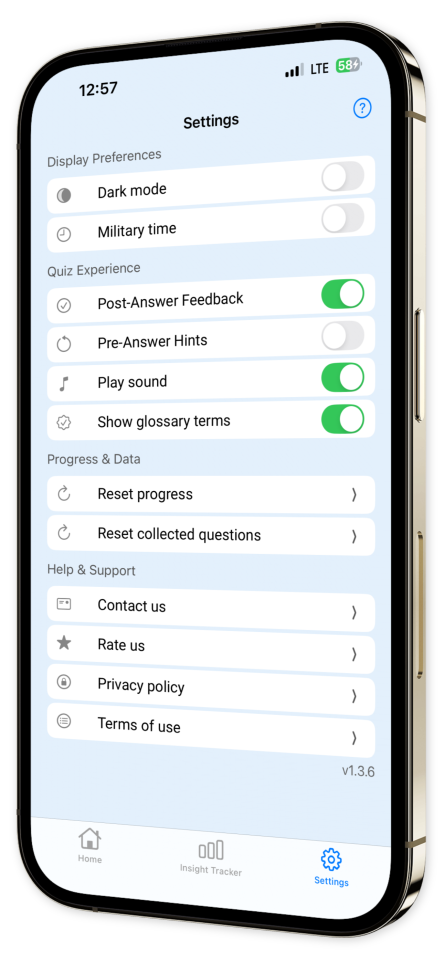

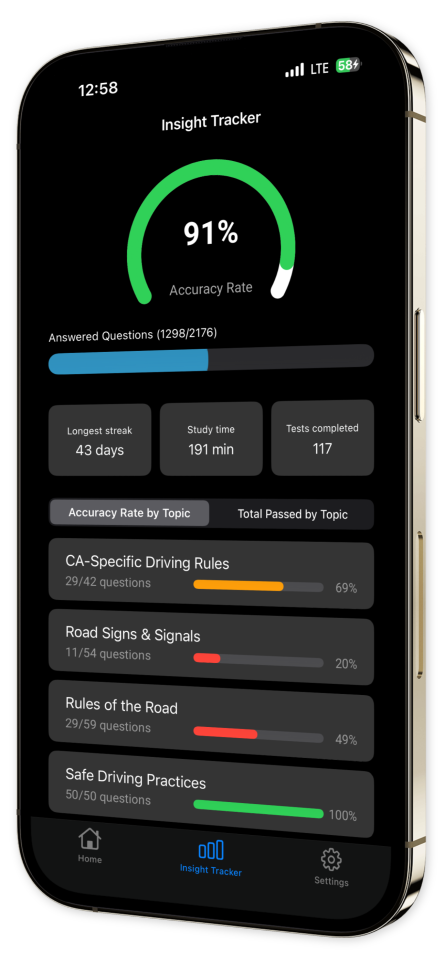

Progress Tracking: Monitor your advancement over time with our comprehensive progress tracking features that keep you informed and motivated.

Offline Access: Prepare anytime, anywhere, even without internet access, making it an ideal solution for convenient learning on the go.

User-Friendly Interface: Experience our streamlined and intuitive app design that keeps your focus on mastering the material without distractions.

Download California DMV Practice Test now and empower yourself with a more effective way to ace your driver's license exam!

With California DMV Practice Test, make every study session count and drive your way to success! Designed with the test-taker in mind, our app transforms the daunting journey of exam preparation into an engaging and manageable experience.

Don't just prepare, excel!

Content Overview

Explore a variety of topics covered in the app.

Example questions

Let's look at some sample questions

CA first question

Increases deduction limits to 70% of AGI for cash donationsReduces taxable income by a flat $300 for everyoneAllows 100% of AGI for deduction if donating cashRemoves deductions for non-itemizers

The CARES Act temporarily allows individuals to deduct cash contributions to public charities up to 100% of their AGI, lifting the usual 60% limit for the tax year.

CA second question

Increases deduction limits to 70% of AGI for cash donationsReduces taxable income by a flat $300 for everyoneAllows 100% of AGI for deduction if donating cashRemoves deductions for non-itemizers

The CARES Act temporarily allows individuals to deduct cash contributions to public charities up to 100% of their AGI, lifting the usual 60% limit for the tax year.

CA third question

Increases deduction limits to 70% of AGI for cash donationsReduces taxable income by a flat $300 for everyoneAllows 100% of AGI for deduction if donating cashRemoves deductions for non-itemizers

The CARES Act temporarily allows individuals to deduct cash contributions to public charities up to 100% of their AGI, lifting the usual 60% limit for the tax year.